The Internal Revenue Service’s announcement of the 2026 standard mileage rates signals a continued response to the high costs of vehicle ownership. For 2026, the business mileage rate has been set at 72.5 cents per mile, a 2.5-cent increase from the 2025 rate of 70 cents. This move reflects the persistent “structural inflation” in automotive costs, particularly in insurance, maintenance, and vehicle acquisition.

IRS Mileage Rate 2026: The New Operational Benchmark

Notice 2026-10 establishes the parameters for deductible vehicle use for the 2026 calendar year. While fuel prices saw some stabilization in late 2025, the rise in fixed costs—like depreciation and premiums—pushed the business rate to its highest level ever.

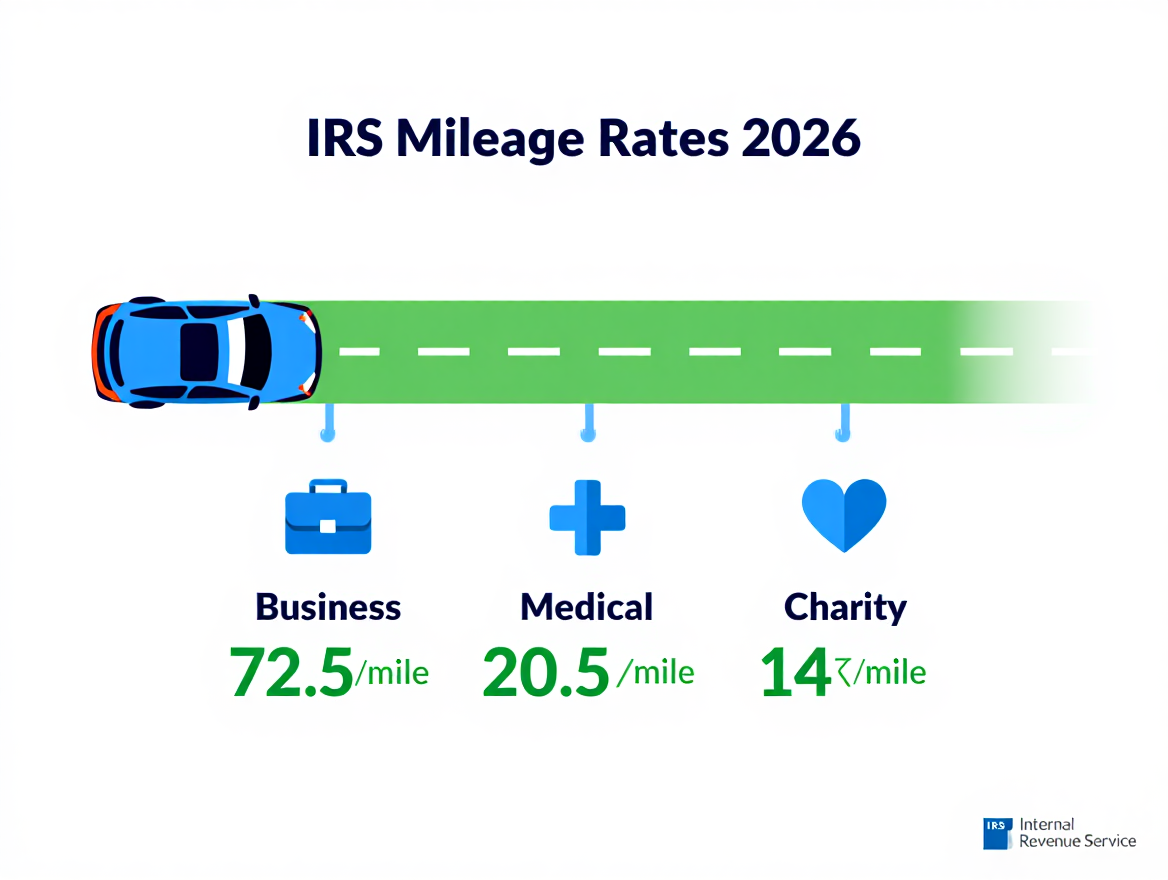

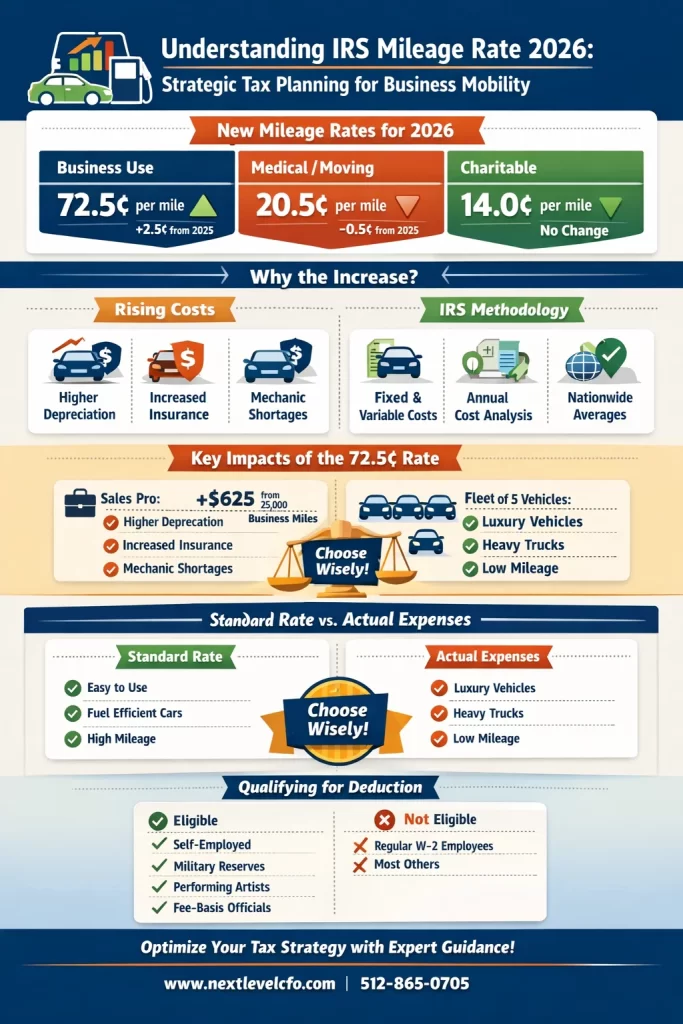

Standard Mileage Rates for 2026

| Taxpayer Classification | Rate per Mile | Cost Basis | Change from 2025 |

| Business Use | 72.5¢ | Fixed + Variable | +2.5¢ |

| Medical/Moving* | 20.5¢ | Variable only | -0.5¢ |

| Charitable Service | 14.0¢ | Statutory | No change |

What Is the IRS Mileage Rate: The Regulatory Framework

The IRS mileage rate functions as a congressionally authorized safe harbour that enables taxpayers to calculate vehicle expense deductions without documenting thousands of individual transactions. Rather than aggregating actual costs, fuel receipts, repair invoices, insurance premiums, and depreciation schedules, taxpayers multiply qualifying business miles by the IRS-prescribed rate to arrive at a deduction the Service accepts without further inquiry.

This system rests on an annual independent cost study analyzing fixed and variable vehicle ownership expenses across automotive classes, geographic regions, and use patterns. The IRS contractor examines fleet management data, insurance industry reports, fuel price surveys, and Bureau of Labour Statistics maintenance indices to construct a composite cost per mile reflecting nationwide averages. The resulting rate reduces administrative burden for taxpayers and the IRS while approximating true economic cost.

The 72.5 percent rate indicates that aggregate vehicle ownership costs increased 3.6% annually, driven primarily by fixed cost inflation. Depreciation just took over as your top mileage cost at 35 cents per mile. That’s a jump from 33 cents last year and 28 cents back in 2023. The reasons? Vehicles are being traded faster, and EV resale values are all over the map.

Federal Mileage Rate 2025: Foundation for Comparison

In 2025, the mileage rate went up to 70 cents (from 67 cents in 2024). The increase happened because cars were depreciating faster and insurance was getting more expensive. This set the pattern for 2026.

2025 Rate Structure (Baseline)

- Business: 70.0¢ per mile (depreciation component: 33.0¢)

- Medical/Moving: 21.0¢ per mile

- Charitable: 14.0¢ per mile

The 2026 increase is part of a longer trend that started in 2022. This includes an unusual mid-year adjustment to manage fuel price swings. Overall, the rate has risen 29.5% since 2021, above inflation.

For a sales professional driving 25,000 business miles annually, the 2.5-cent increase generates $625 in additional deductible expense. For a five-vehicle service fleet averaging 30,000 miles per vehicle, the incremental deduction reaches $3,750, material enough to affect quarterly estimated tax calculations.

IRS Balance Rate: Fixed and Variable Cost Methodology

The IRS balance rate methodology balances fixed ownership costs against variable operating expenses. The IRS study disaggregates these components to ensure the composite rate reflects empirical cost data rather than arbitrary indexing.

Fixed Cost Components (Ownership Economics)

- Depreciation: How you account for your car’s purchase price over time

- Insurance: What you’re paying for full coverage protection

- Registration/Licensing: Annual fees to keep your plates and registration current

- Financing: Interest expense on vehicle loans

Variable Cost Components (Operating Economics)

- Fuel and oil: Direct energy costs

- Maintenance and repairs: Routine service and unscheduled repairs

- Tires: Replacement wear items

- Direct financing costs: Interest portion scales with use

The 2026 increase indicates fixed cost inflation, particularly depreciation and insurance, outpaced variable cost moderation. Insurance premiums have increased 15% annually since 2022, driven by advanced driver-assistance system repair costs and climate-related catastrophic losses. Simultaneously, supply chain constraints and technician shortages pushed maintenance labour rates up 8-12% annually.

Conversely, fuel price stabilization in late 2025 allowed the medical/moving rate to decline slightly, as variable costs moderated sufficiently to offset a portion of fixed cost increases.

Will Mileage Increase in 2026: Resolved and Projected

- 2026 rate: 72.5¢ (confirmed increase)

- 2027 outlook: Continued increases likely, possibly slower pace

- Expected range: 1-3¢ annual increases through 2027

Upward Pressure:

- EV price premiums (20-40%) → higher depreciation

- Rising insurance (repair costs + climate losses)

- Mechanic shortage → elevated labour rates

- Higher interest rates → increased financing costs

Downward Pressure:

- Better fuel economy (regulations + hybrids)

- Potential economic slowdown

- Supply chain improvements → parts price stabilization

- Consensus: Moderate, steady increases continuing 2021-2025 trend

Taxpayer Eligibility and Compliance Framework

The 2017 Tax Cuts and Jobs Act wiped out miscellaneous itemized deductions until 2025. That created a serious problem for mileage deductions; most people who used to claim them can’t anymore. The new reality is that your taxpayer category determines everything about whether you can deduct mileage, and most categories lost this benefit entirely.

Self-Employed Professionals (Schedule C)

Business mileage deductions are unrestricted for gig workers and freelancers, applying the full 72.5-cent rate to all qualifying miles. The mentioned rate applies to all qualifying miles without threshold limitations.

Qualified Employees (Statutory Exceptions)

Four categories retain deduction rights:

- Armed Forces reservists travelling over 100 miles

- Qualified performing artists with multiple employers

- Fee-basis state/local government officials

- Employees with impairment-related work expenses

These deductions are claimed on Form 2106 and flow to Schedule 1 as adjustments to income.

W-2 Employees (General Disallowance)

Standard employees cannot claim mileage deductions, making the employer reimbursement policy critical. Employees should negotiate rates at or above the IRS standard, as employer deductions remain unaffected while employee compensation stays tax-free.

Documentation and Audit Defense Strategy

The IRS identifies vehicle expenses as a Tier 1 examination priority. High-mileage returns face enhanced scrutiny, requiring robust contemporaneous records.

Mandatory Substantiation Elements

Acceptable mileage logs must contain:

- Trip date

- Origin and destination

- Business purpose (client, project, revenue activity)

- Odometer readings or point-to-point distance

Contemporaneous Requirement

The IRS disallows reconstructed logs created from memory or calendar entries. Contemporaneous means recorded at or near trip time, with consistent patterns demonstrating ongoing diligence. Examiners test authenticity by comparing claimed mileage against known distances and revenue patterns.

Digital Tracking Implementation

Professional-grade applications automate compliance through GPS verification, calendar integration, cloud-based tamper-evident storage, and IRS-formatted reports. For taxpayers claiming over 20,000 business miles annually, digital tracking transitions from best practice to mandatory risk management.

Strategic Decision: Standard Rate vs. Actual Expenses

Taxpayers must elect per vehicle in the first business-use year. This binding decision generally cannot be reversed.

Standard Rate Advantages

Scenarios where 72.5 cents optimizes deductions:

- Fuel-sipper advantage: 50 MPG at $3.50/gallon = 7¢/mile, well under IRS rate

- High-mileage payoff: 40,000 miles = $29,000 deduction, receipt-free

- Simplicity bonus: Minimal logs = lower prep fees and less audit risk

- New vehicle simplicity: Captures depreciation without complex MACRS calculations

Actual Expense Method Superiority

- Luxury vehicles: Premium SUVs incur elevated depreciation, insurance, and maintenance expenses exceeding standard calculations.

- Low-efficiency vehicles: Heavy trucks with reduced MPG face higher per-mile fuel costs.

- Low mileage scenarios: When business miles are limited but fixed costs remain high, actual per-mile costs can far exceed standard rates.

Allocation Complexity

When using the actual expense method, start by calculating your business-use percentage. This means dividing your business mileage by your total annual mileage. A vehicle with 18,000 business miles and 6,000 personal miles would show 75% business use.

Corporate Implementation Requirements

Businesses must update policies and systems effective January 1, 2026.

Accountable Plan Updates

Reimbursements under accountable plans must:

- Not exceed 72.5 cents per mile

- Require timely mileage logs

- Mandate the return of excess reimbursements

Action Item: Update employee handbooks, payroll systems, and expense management platforms to reflect the new rate by Q1 2026.

FAVR Program Consideration

The Fixed and Variable Rate (FAVR) programs pay separate allowances for fixed and variable costs, adjusting for geographic variations and vehicle types. FAVR plans must adhere to IRS safe harbour parameters, including maximum vehicle cost limits ($61,200 for 2025-placed automobiles). While administratively complex, FAVR often proves more equitable than flat cents-per-mile rates for geographically dispersed workforces.

Forward-Looking Implementation Strategy

For Self-Employed Professionals:

- Implement mileage tracking before January 1, 2026

- Project 2026 actual expenses using 2025 data to optimize standard vs. actual election

- For new 2026 vehicle acquisitions, make method election by first business-use filing

- Maintain separate accounts for vehicle expenses if selecting the actual method

For Business Owners:

- Update reimbursement policies and communicate changes

- Train managers and employees on documentation requirements

- Evaluate the FAVR program’s feasibility for high-mileage or geographically dispersed employees

- Audit state labour law compliance, as California and other jurisdictions mandate reimbursement of necessary business expenses

For W-2 Employees:

- Confirm employer reimbursement meets or exceeds 72.5 cents

- If inadequately reimbursed, assess qualification under four statutory exceptions

- Negotiate higher reimbursement rates, citing the IRS standard as the industry benchmark

Conclusion

The IRS mileage rate for 2026 increases to 72.5 cents per mile delivers meaningful tax relief while acknowledging sustained automotive cost escalation. This adjustment reflects rigorous analysis of fixed and variable cost components, particularly depreciation.

At Next Level CFO, we’ve guided dozens of growing companies through precisely this transition. Whether you’re a self-employed professional optimizing your first vehicle election, a business owner restructuring fleet economics, or an enterprise evaluating FAVR program feasibility, the principle remains consistent: financial clarity drives business growth.

The rate’s strategic importance extends beyond immediate deduction value; it signals IRS recognition that vehicle operating economics have fundamentally shifted. Let’s get your numbers working as hard as you do. Schedule a free strategy call with our team to evaluate how the 2026 mileage rate shifts your tax plan and your operational strategy.